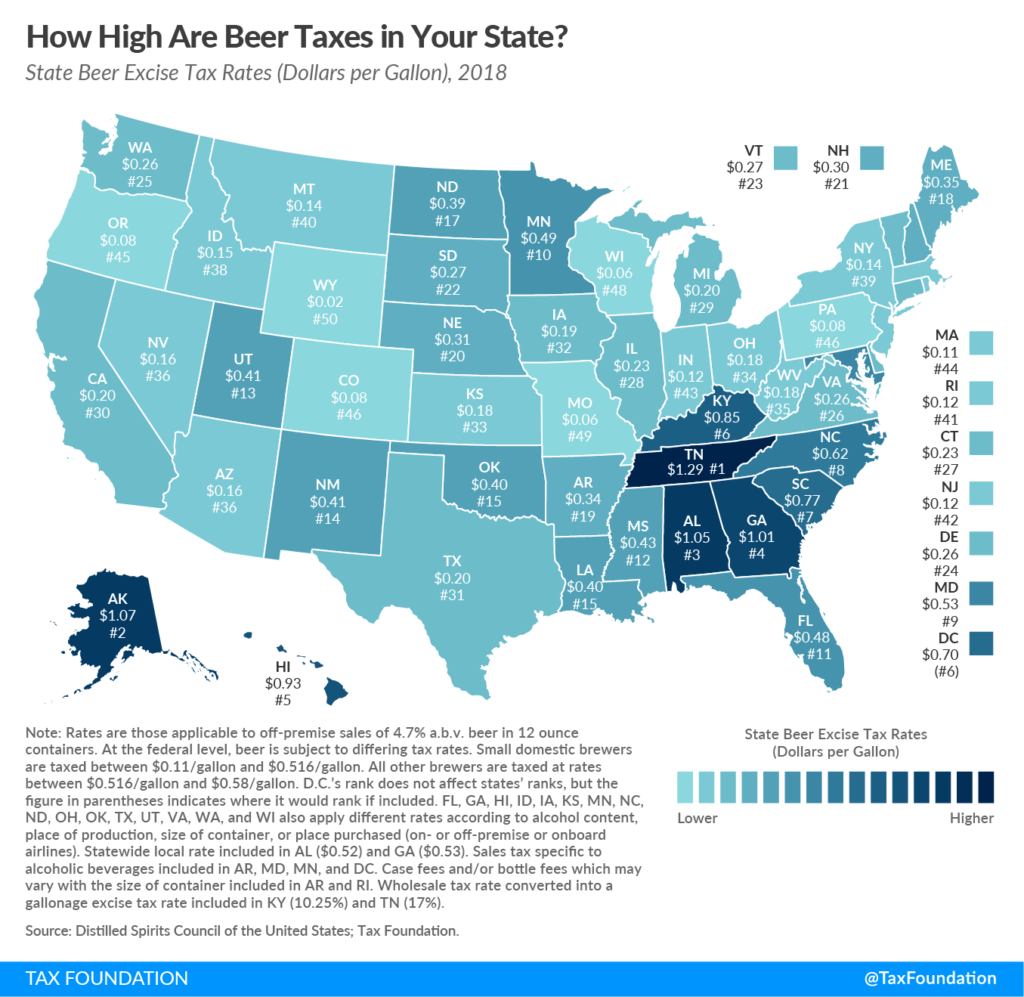

According to the Beer Institute, “Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.” And the Tax Foundation just put together a nifty infographic so you can see how high beer taxes are in your state and in others…

According to the Beer Institute, “Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.” And the Tax Foundation just put together a nifty infographic so you can see how high beer taxes are in your state and in others…

And while some of you might be on vacation, there’s never a taxation vacation when it comes to beer.

In fact, research has shown that approximately 40 percent of the retail price of beer goes to covering all the a multitude of applicable taxes including federal and state excise tax, state and local sales taxes and hidden fees levied on brewers, importers, or other wholesalers as a percentage of revenue generated.

Excise taxes differ from general sales taxes, which are tacked on after the price of goods is subtotaled.

And according to the Tax Foundation “most states collect beer excise taxes from retailers according to the quantity of beer sold (usually expressed as a rate of dollars per gallon), and vendors in turn pass those costs along to consumers in the form of higher prices.”

And as you can see on the infographic map below, state excise taxes can vary widely…from as low as $0.02 per gallon in Wyoming to as high as $1.29 per gallon in Tennessee.

So crack open a beer and check out what you’re paying in your state….

H/T to the Tax Foundation for helping us wade through subject of beer taxes and for their helpful beer tax map. And The Savory.com for the George Washington money image

American Craft Beer The Best Craft Beer, Breweries, Bars, Brewpubs, Beer Stores, And Restaurants Serving Serious Beer.

American Craft Beer The Best Craft Beer, Breweries, Bars, Brewpubs, Beer Stores, And Restaurants Serving Serious Beer.