Here's How Much Beer Taxes Cost in Every US State

Every state has its favorite beer. Whether that's Furious or Sweet Potato Cream Stout, every favorite beer comes with its own state-specific tax.

You probably don't spend much time thinking about the sliver of the Venn Diagram between beer and taxes. However, the Beer Institute says its the most expensive "ingredient" in beer. (Though, they're talking adding up taxes all the way through production and distribution before you pick up that six-pack.)

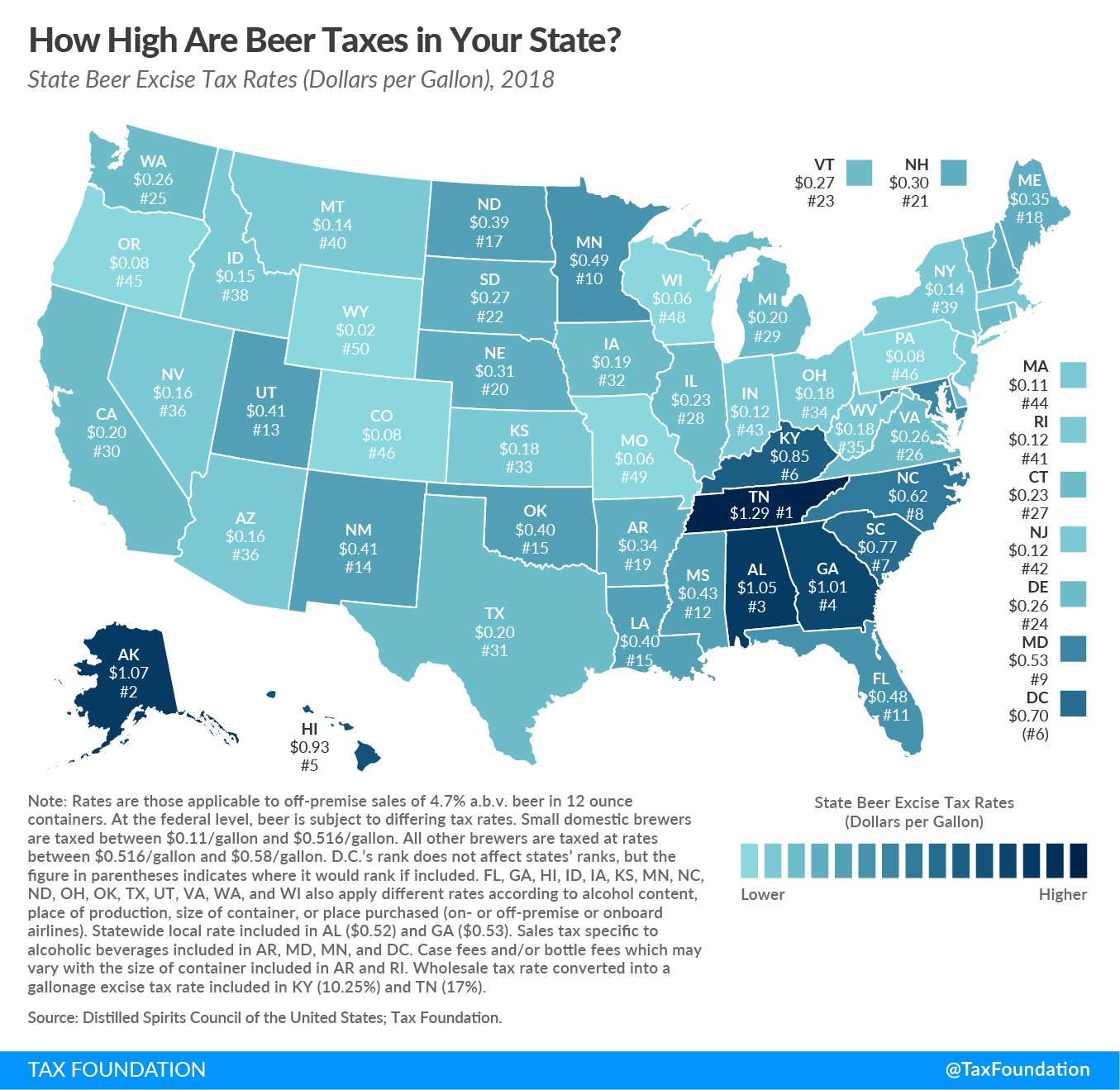

As it did last year, The Tax Foundation -- a non-profit critical of tax policies -- has compiled every state's beer tax details into the map below to show who is paying the most in beer taxes.

Not every state taxes beer in a similar way. At times, this is comparing apples and oranges as far as a consumer is concerned. The example given by the Tax Foundation is Minnesota, where the retailer is taxed at $.15 per gallon while the sales tax of 9% is applied at the point of sale. Additionally, there are tax variations based on the type of beer you're purchasing. For instance, in Idaho, any beer with a 4.1% ABV or higher is classified as a "strong beer" and taxed at the higher rate for wines.

Overall, there's a wide gulf between the lowest and highest rates. Wyoming is the lowest at just $.01 per gallon, and Tennessee is at the other end of the spectrum at $1.29 per gallon.

It's interesting, but probably not going to stop any from checking out that dank-smelling Hemperor or whatever's on tap down the street.

Sign up here for our daily Thrillist email and subscribe here for our YouTube channel to get your fix of the best in food/drink/fun.